Cash Flow – Where Does The Money Go ?

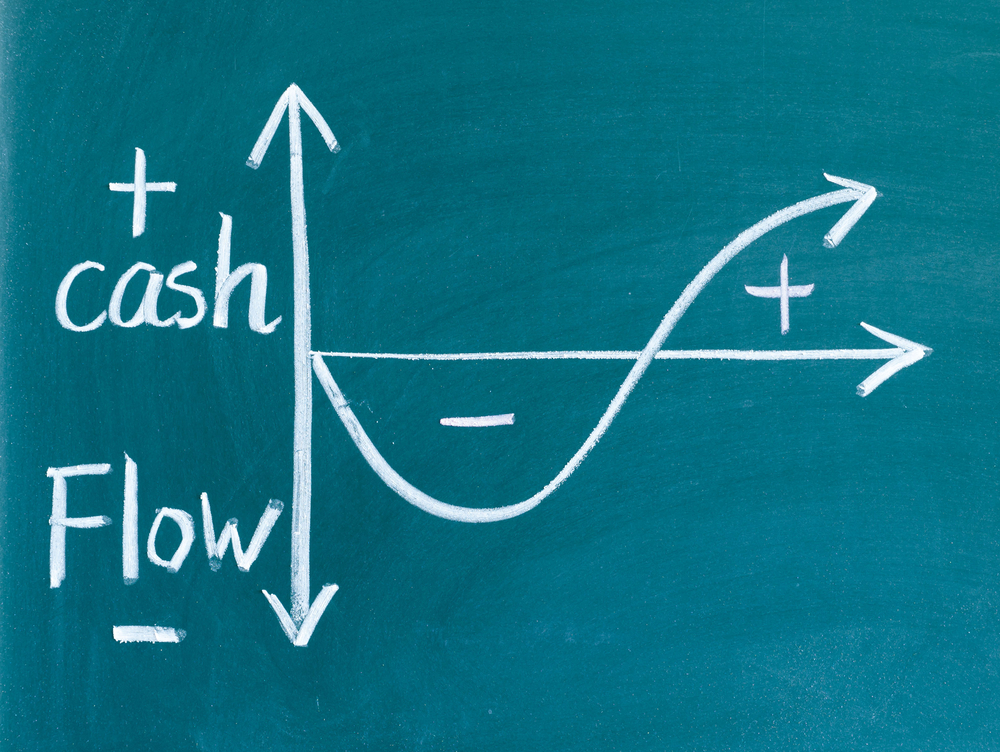

Cash Flow Forecasting With ever-increasing supplier prices and inflation at a 30 year high, managing your business’s cash flow is an essential tool in maintaining resilience and being able to adopt flexible strategies for success. Fund flows are a reflection of all the cash that is flowing in and out of a business. Owners can […]

Cash Flow – Where Does The Money Go ? Read More »