Xero Accountants

Let us help you on your Xero Journey. We are Xero Gold Partners and have helped hundreds of businesses like yours with the best in class Xero cloud accounting software.

Xero Accountants and Bookkeepers in Scotland

What is Xero?

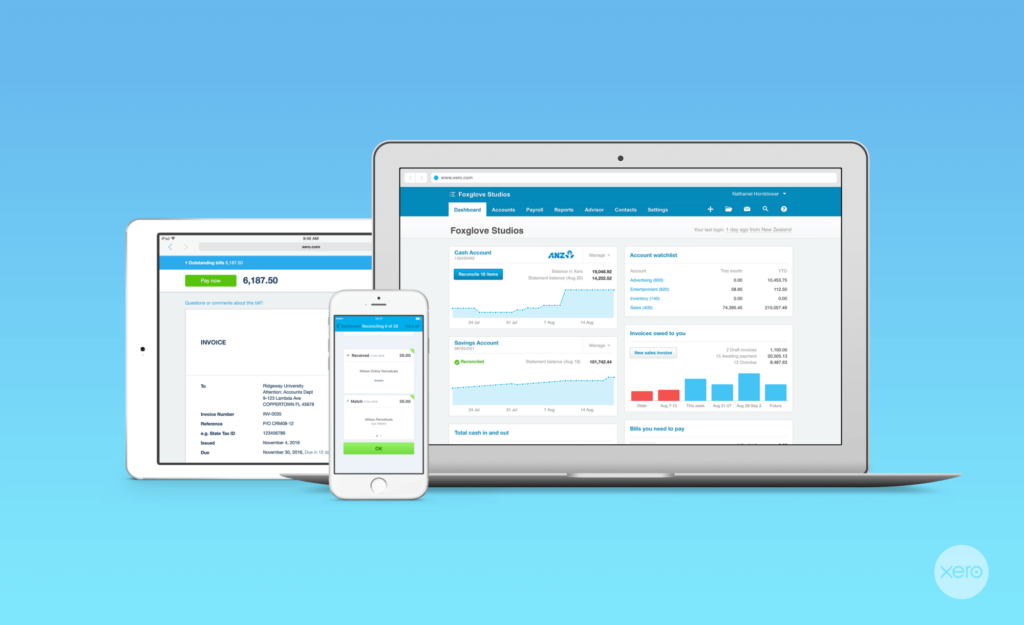

Xero is an easy to use Cloud Accounting Software for small and medium businesses. Because your data is kept on the cloud you can access it from anywhere, meaning that you can work flexibly and keep track of your business from your laptop or with the mobile app.

Xero has lots of great features including the dashboard that allows you to manage your finances in real time, submitting VAT returns online, live bank feeds and managing your customers and suppliers.

How does Xero accounting and bookkeeping software work?

Xero accounting software works by keeping all your data safely stored on Xero’s servers on the cloud. This means that you can access it from anywhere through a browser and do not have to have any special software installed on your PC. You can access it through a browser on your phone or download the Xero App.

After we sign you up with Xero you can connect your accounting software to your bank using Xero’s bank feeds. This means your bank information will be pulled across from your bank automatically every day saving time in inputting transactions and making sure you have real time financial data to use while running your business.

What is the Xero App Marketplace?

One of the great things about Xero is that it is integrated with many other software services so that clients can customise their business Xero to their own niche.

The Xero App Marketplace (link here) allows access to hundreds of other apps from CRM to Specialist Invoicing to Industry Specific add ons. Many of our clients make great use of integrations like A2X for Ebay sellers and HubDoc for automatic document scanning.

Why should you use us as your Xero accountants?

Sutherland Black act as Xero accountants for hundreds of businesses who use all the features of Xero. We can provide different levels of accounting services depending on your needs. We can just use your Xero data to prepare your annual accounts and tax or we can provide you with a complete bookkeeping and VAT service. Many of our clients do their own invoicing from Xero and let us deal with everything else.

When we combine Xero with our other accounting services it makes a great streamlined service for our clients who can get on with doing what they do best instead of worrying about the accounts.

What is the best Cloud Accounting Software?

In our opinion Xero is the best cloud accounting software available for small businesses in the UK. Xero now has over 2 million users worldwide and is growing at a phenomenal rate. Their ambition can be seen by the fact that Steve Vamos, Xero’s CEO appointed in 2018, had previously been with Apple and Microsoft.

How Does Xero Accounting Work With Making Tax Digital?

HMRC are slowly changing their systems over to a new system called “Making Tax Digital” (MTD). This basically means that when you submit a return to HMRC instead of them just getting the overall totals they get the backup financial transaction detail as well.

Xero is fully compliant with VAT MTD which went live in 2019 and is now compulsory for all VAT registered businesses. In the future other areas of tax will start to have this requirement too. Businesses who use Xero accounting software will be ready for these changes as they arrive as Xero have stated that they will support all future MTD requirements.

Is it easy to change to Xero?

We have migrated hundreds of clients to Xero. Our accountants are fully trained in the migration process and we can manage the transition for you. Using online accounting software is really a necessity in the 21st century so if you are still using desktop based software now is the time to change.

Is Xero software good for your business?

We have observed that our clients who have the most profitable small businesses tend to have the best, most up to date bookkeeping and financial data. Businesses who use Xero accounting software with live bank feeds find it easy to keep up to date with their bookkeeping.

When you pair the bank feeds with great invoicing and supplier management you have a powerful combination for streamlining your business processes.

Sutherland Black are Xero Gold Partners

When you are looking at Xero accountants you need to make sure that they are experts. Sutherland Black have been awarded the prestigious Xero Gold Partner status due to the volume of Xero account software clients we have and the Xero training that our staff have undertaken.

Limited Company Accounts And Tax

Xero Cloud Accounting

Small Business Accounting

Bookkeeping Services

VAT Services

Payroll and Auto Enrolment Services

Book your free initial meeting

Get in touch to arrange a phone call or free initial meeting to see if we can help you with your issues. We can meet you by Zoom, at your premises or at our offices.

* Please note we are only taking on business clients at the moment. We will not be able to respond to Personal Tax only queries including Capital Gains Tax (CGT) and Property Tax.

Edinburgh Office

- 1 Lochrin Square, 92 - 98 Fountainbridge, Edinburgh EH3 9QA

- 0131 610 3050

Glasgow Office

- 100 West George Street, Glasgow G2 1PP

- 0141 432 3045

Explore Our Services

- Xero Cloud Accounting

- Limited Company Accounting

- Small Business Accounting

- Start-up Accounting

- Bookkeeping

- Personal Tax

- Payroll

- VAT

Explore Our Services

- Pricing

- News

- About

- Contact

Explore Our Services

- Pricing

- News

- About

- Contact

© 2022 Sutherland Black (Scotland) Ltd. All Rights Reserved. | Privacy Policy | Sitemap